Wool Market Update (May 2025)

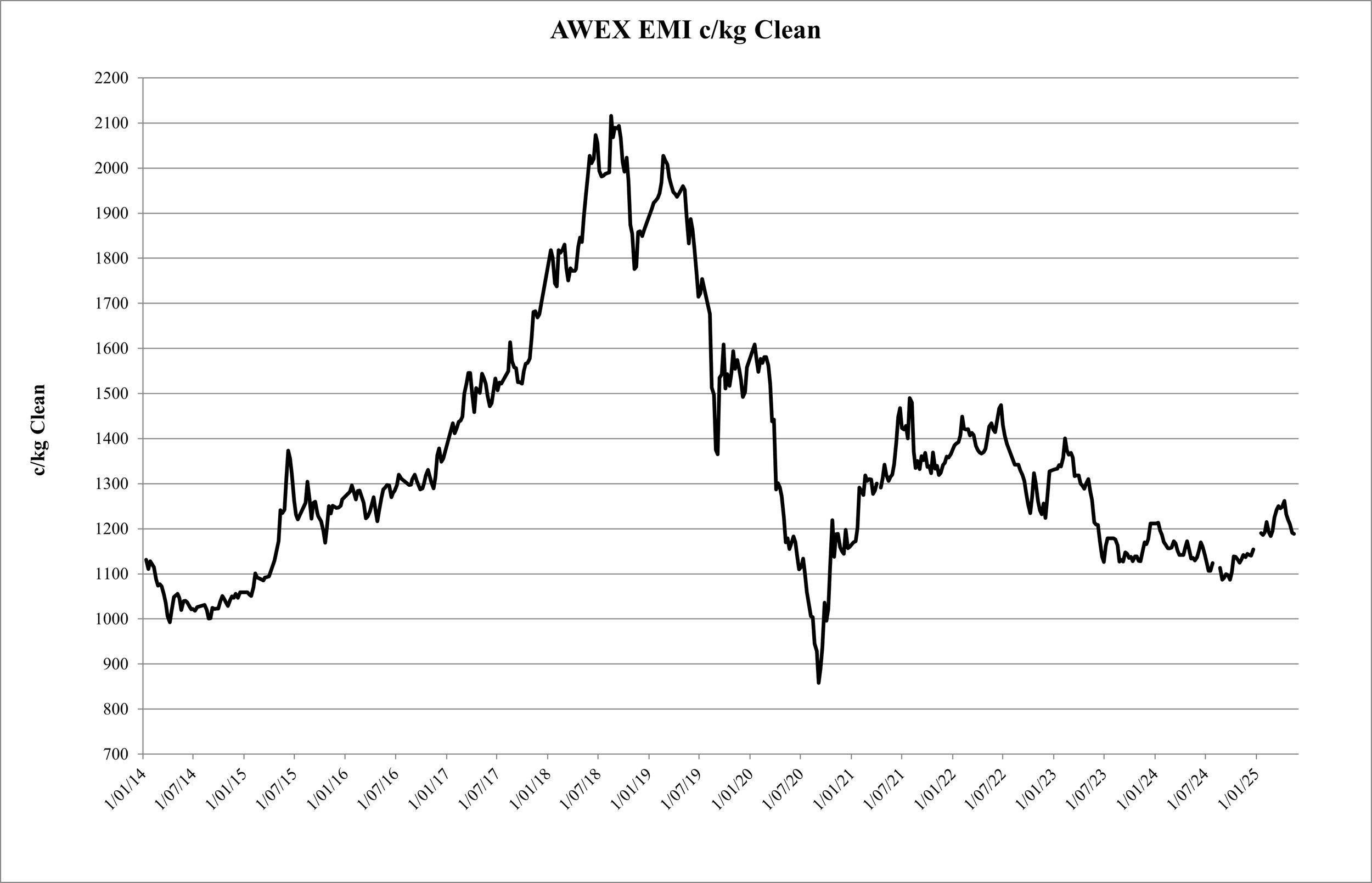

The current wool market has been relatively stable since the highs and lows seen between 2018 and 2021. The current EMI is sitting at 1,189c/kg clean, a gain of approximately 54c/kg or 4.8% year on year. The current outlook on wool prices mirrors the last two years, with no one factor having a significant influence on the market.

The relatively small movements in the wool price during this period, are largely due to fluctuations in the AUD/USD exchange rate, plus perceptions on the strength of the global economy.

The current wool industry is full of doom and gloom, however as the graph below demonstrates, other than for a small spike during summer 2023/24, the market has not been higher since June 2023. Understandably, it is not very palatable fully supplementary feeding sheep through autumn and the prospect of continuing through winter, when wool prices are below average. In comparison, during the last drought in 2018/19, wool prices were almost double and the wool more than paid for the cost of feeding.

Wool supply is forecast to decrease by 11.8% during the 2024/25 season, due to decreased sheep numbers, while wool cut per head is expected to remain stable. Forecast wool production for the 2025/26 year, is expected to fall a further 8.4%. WA is leading the reduction in sheep number, falling by 19.2%, followed by SA, Vic, NSW, Qld and Tas, with respective reductions of 13.2%, 12.2%, 9.0%, 7.4% and 7.1%. The fall in sheep numbers is due to several factors; the looming ban on live export sheep in WA, plus poor seasonal conditions in SA, Vic and NSW, coupled with depressed wool prices, which have had the greatest influence in these states. This reduction in supply is not expected to make as large an impact on wool prices, compared to other factors, such as fluctuations in the AUD/USD exchange rate and the global economic outlook.

The following graph shows the AWEX Eastern Market indicator (EMI) in cents per kilogram clean, from 2014 to date.

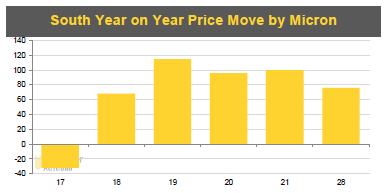

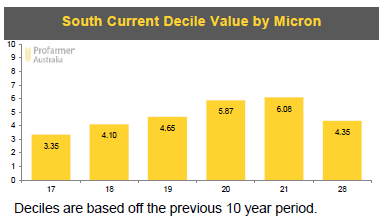

The current 10 year Decile wool prices by micron and 12 month price change can be seen in the following graphs published by Profarmer. As the graphs below show, fine and superfine wool has fared the worst over the last 12 months, with current decile prices across the 17-19 micron range below a Decile 5.

An EMI currently of 1,189 c/kg clean, should result in net average returns to clients with 19 micron Merino clips, of around $9.80/kg greasy, assuming a yield of 65%. This would produce a return of $58.77/head net for sheep cutting 6.0 kg/head greasy.

This price of $9.80/kg net should exceed the average budgeted Break Even Price for clients, providing a good profit margin for wool growers, particularly those with a lower than average cost of production.