Interest Rate Update (May 2025)

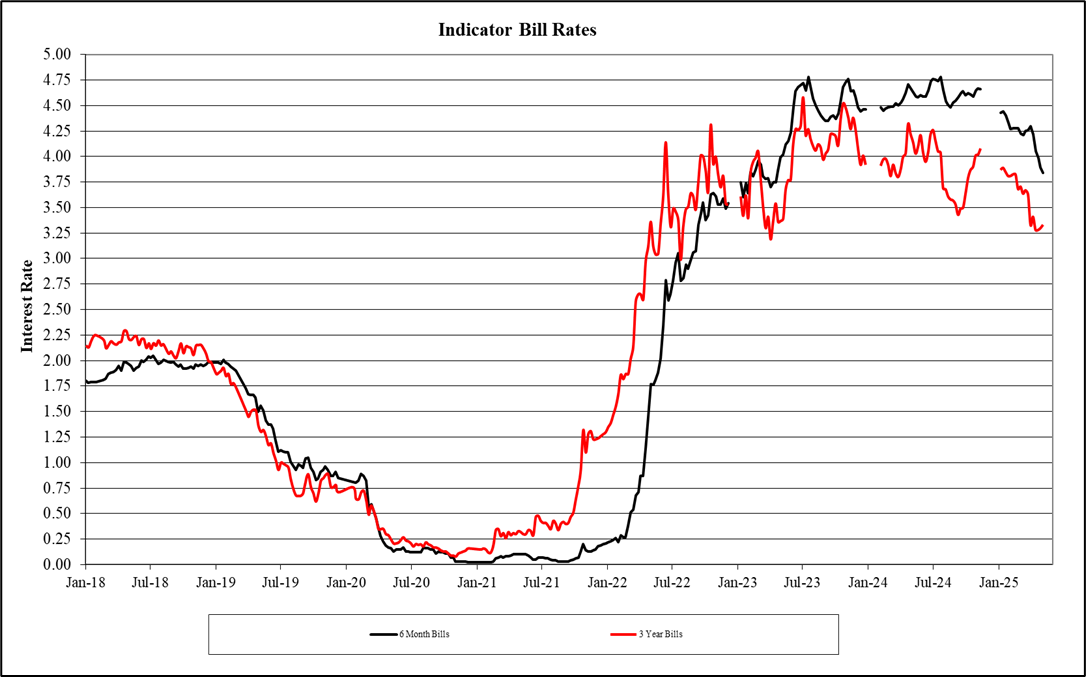

The following graph shows movements in both the 6 month and 3 year Bank Bill yield rates, for the period January 2018 to date.

These rates are wholesale rates which are net of any margin charged by financial institutions. It is not uncommon for retail prices for 3 year fixed rates, to be 0.30% - 0.50% pa or 30 to 50 basis points above the wholesale price.

Currently the 6 month wholesale Bill rate is 3.83% pa and the 3 year wholesale Bill rate is 3.33% pa, a discount of 0.51% pa or 51 basis points for the longer term. As the graph below indicates, rates have fallen rapidly since January 2025. During this period, domestic inflation rates have fallen back within the RBA’s guidelines, while economic growth has plateaued. Internationally, the return of Donald Trump as President of the USA and his corresponding trade policies, has sparked economic uncertainty and volatility, not only in the US but globally. Without a major backdown on tariff policies, it is expected that the US will enter a recession, thus impacting global economic growth. All these factors have had the effect of increasing the likelihood of interest rate cuts.

The market forecast with a high degree of confidence, a rate cut of at least 25 basis points during May, which has occurred. Recent stronger than expected employment data, may temper the quantum of the RBA’s future rate cut decisions. Also, many of the re-elected Labor government spending commitments, are inherently making it more difficult for the RBA to deliver more interest rate cuts in the short to medium term.

Predicting interest rate movements is challenging, particularly due to the current extreme market volatility. However, this market decline and inverse yield curve in the wholesale market, may provide businesses the opportunity to hedge some of their interest rate risks.