Key Financial Ratios

Some key indicators based on predicted EBIT (earnings before interest and tax) have been calculated on the 2023/24 client budget data. EBIT is a measure of profitability used across various businesses and industries.

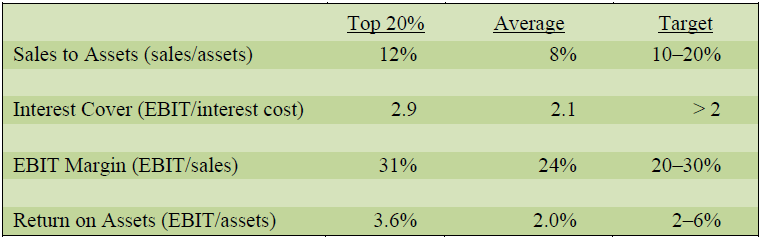

The average results for both the top 20% of clients plus average for the client group, ranked on Return on Assets, along with the desired range are as follows:

The first ratio is a measure of operating efficiency and capital utilisation, the second a measure of debt servicing ability (comfort factor), while the last two are a measure of profitability.

EBIT Margin is also a reflection of the risk profile of the business, with a high figure representing low costs relative to income. Mixed farms generally have a higher EBIT margin than those who crop exclusively.

All of the parameters in the table have decreased since the previous COP article for all client groups. Sales to assets and return on assets have decreased due to the reduction in commodity prices in the last 6-12 months. Interest cover has contracted significantly due to the large interest rate rises clients have experienced. EBIT margins have also decreased due to an increase in cost of inputs, plus a contraction in commodity prices.

The results above show that the top performing clients can achieve financial ratios comparable to other medium – to – large businesses, outside agriculture. A strong focus on cost control is important for successful businesses, as this can be heavily influenced by management. Most commentary regarding farm financial performance is related to the value of commodities, however, the price received for commodities is generally outside the control of management.

This table reinforces that costs are the biggest driver of risk and profitability, plus Return on Assets, as there is minimal difference between the Sales/Asset ratio of the two groups. Lower risk and greater profitability, is depicted by the higher EBIT Margin for the group having the highest Return on Assets.