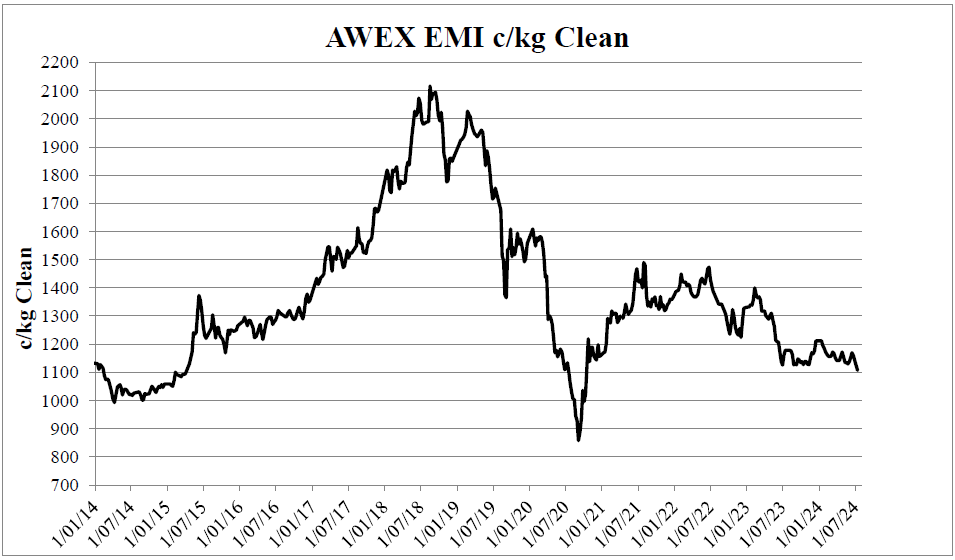

Wool Market Update (July 2024)

The AWEX EMI price is currently 1,107c/kg clean, a reduction of 55c/kg or 6% year on year. This is a moderate price reduction when compared to all the doom and gloom coming from the industry. As the Profarmer graphs below illustrates, all micron grades have decreased. Fine wools have fallen further than the broader merino clip, however due to the comparatively higher opening value, <18 micron wool is still the best performing micron category.

Deciles are based off the previous 10 year period

The falling market has been caused by a continuation of the deterioration of the global economy, affecting demand for luxury/discretionary items that merino wool produces. In addition to this, an appreciating AUD has reduced growers’ terms of trade. An interesting observation made during recent commentary, was that now over 35% of the Australian clip is made up of superfine wool, the category most affected by cost-of-living pressures.

Assuming a yield of 65%, the current price should result in net average returns for 18 micron wool, of around $9.52/kg greasy. This would produce a return of $57.13/head net for sheep cutting 6.0 kg/head greasy.

This price of $9.52/kg net compares with the average budgeted Break Even Price for clients in 2024 of $6.26/kg, still providing a significant profit margin for low cost producers.

The following graph shows the AWEX Eastern Market indicator (EMI) in cents per kilogram clean, from 2014 to date.