Interest Rate Update (July 2024)

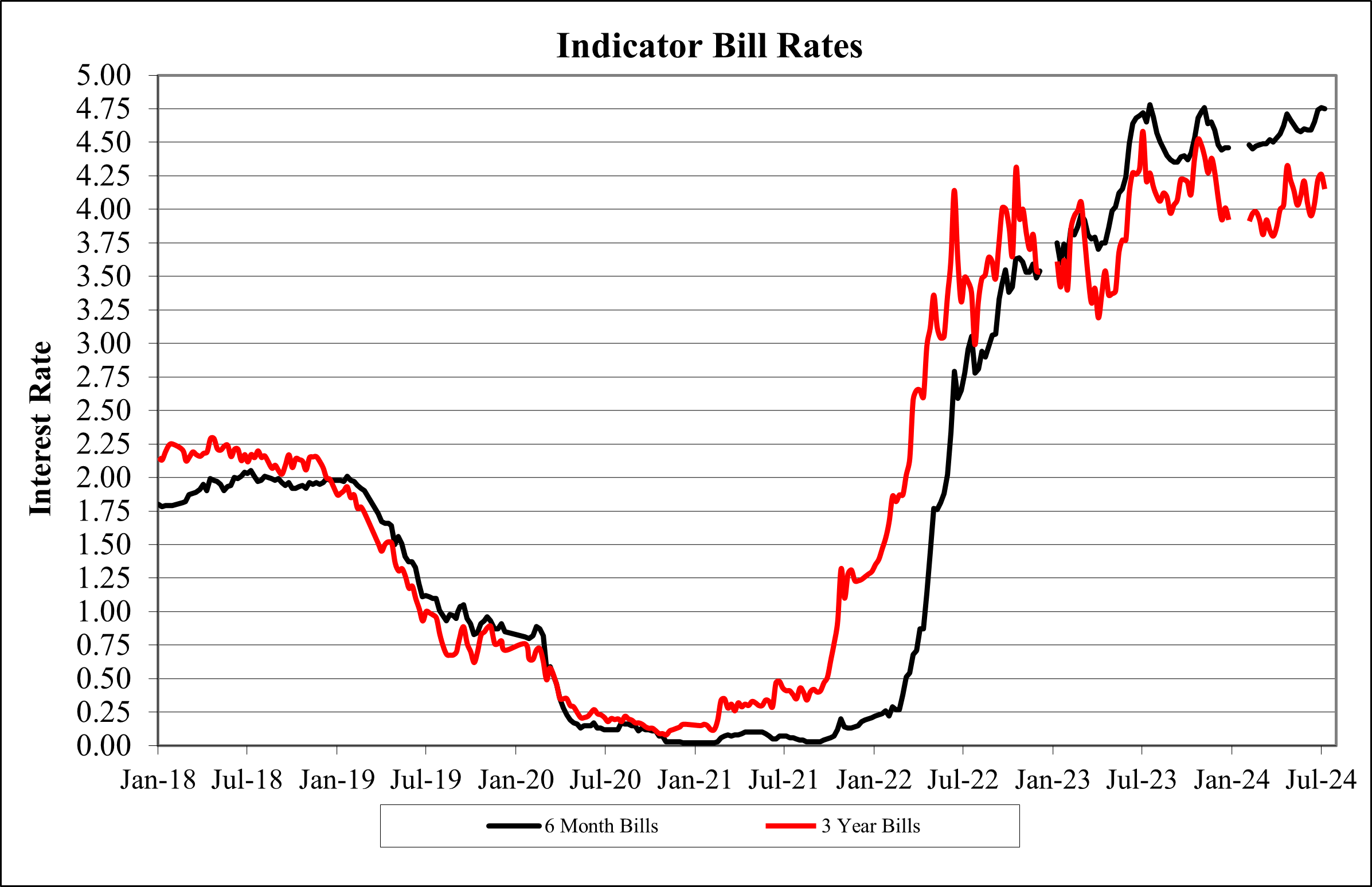

The following graph shows movements in both the 6 month and 3 year Bank Bill yield rates, for the period January 2018 to date. These rates are wholesale rates which are net of any margin charged by financial institutions. It is not uncommon for retail premiums for 3 year fixed rates, to be 0.30% pa or 30 basis points above the wholesale premium.

Currently the 6 month wholesale Bill rate is 4.75% pa and the 3 year wholesale Bill rate is 4.15% pa, a discount of 0.60% pa or 60 basis points for the longer term. The rates have remained relatively stable in the last 12 months, with the only notable change being that the 3 year money discount has continued to gradually widen. This is depicted by the figures of 12 months ago, where the 6 month rate was 4.72% and the 3 year rate 4.58, a discount of 0.14% or 14 basis points to the longer-term.

Despite the economic pain being felt by many throughout the economy and the associated reduction in discretionary spending, inflation figures have remained persistently above targeted levels. The most recent predictions are suggesting that there may be an additional interest rate rise later in 2024, in an attempt to push inflation down. Though in the medium term, rates are expected to come back to what is considered a more sustainable level for the economy.

Given the current uncertainty in the global and domestic economy, it is particularly difficult to predict what rates may do, but markets are factoring in a decrease in the medium to longer term.