Interest Rate Update (November 2023)

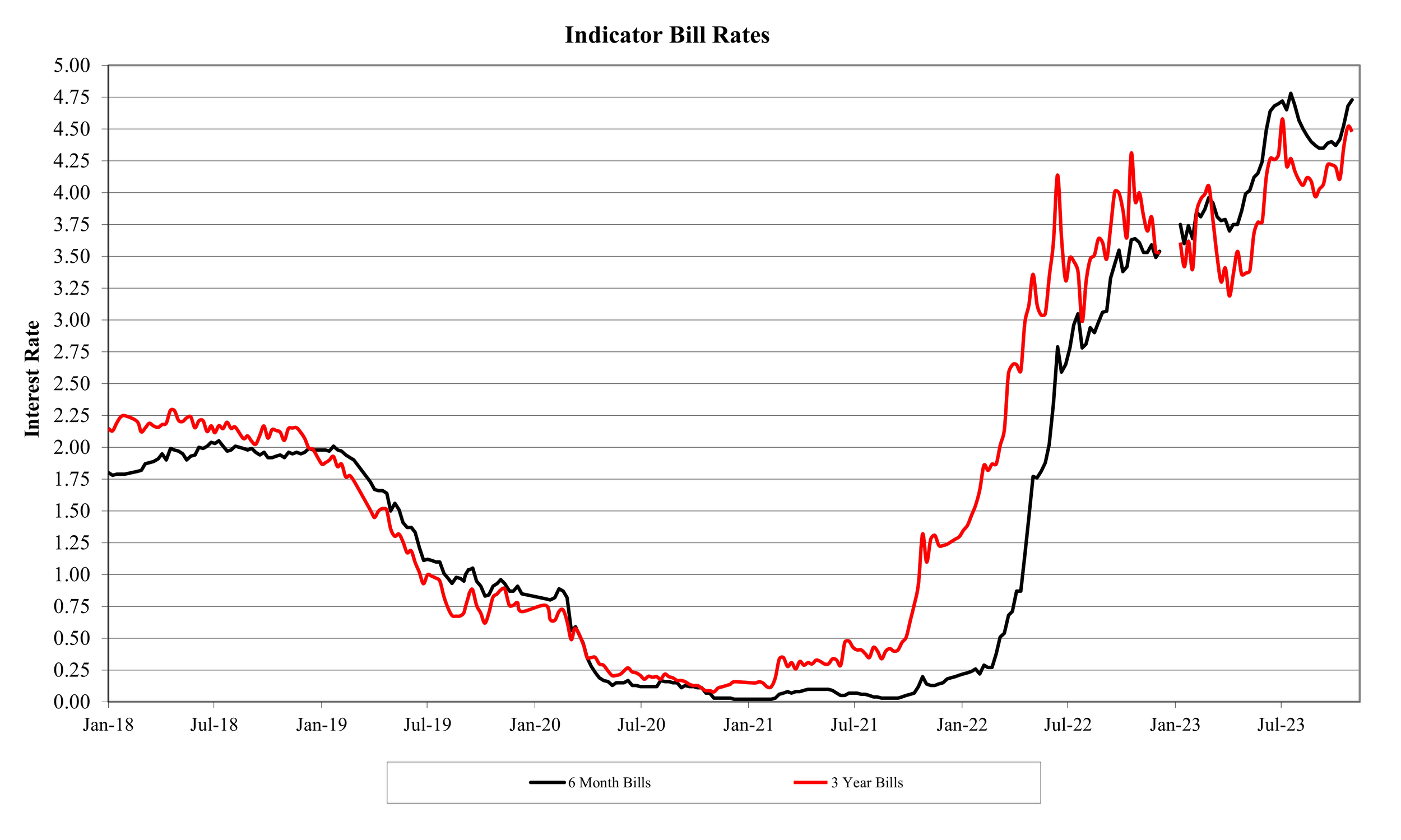

The following graph shows movements in both the 6 month and 3 year Bank Bill yield rates, for the period Jan 2018 to date.

These rates are wholesale rates which are net of any margin charged by financial institutions. It is not uncommon for retail premiums for 3 year fixed rates, to be 0.30% pa or 30 basis points above the wholesale rate.

Currently the 6 month wholesale Bill rate is 4.73 % pa and the 3 year wholesale Bill rate is 4.48 % pa, a discount of 0.25% pa or 25 basis points for the longer term. The discount for the longer term has persisted since February 2023, which is an indication that the market may see a gradual decline in interest rates sometime during 2024.

The domestic economy is in a peculiar predicament at present. Persistently high inflation is forcing the hand of the RBA to continue lifting interest rates. However other components in the economy are showing signs of distress. Economists are predicting a contraction in economic growth in 2024, which in turn is expected to lead to a reduction in rates. This is clearly indicated by the rate discount for the longer term. If not already implemented, clients should contact their banker to discuss if moving to longer term pricing periods would be advantageous.