Grain Market Update - Canola (September 2024)

Article written by : Michael Jones, Grain Focus, Young

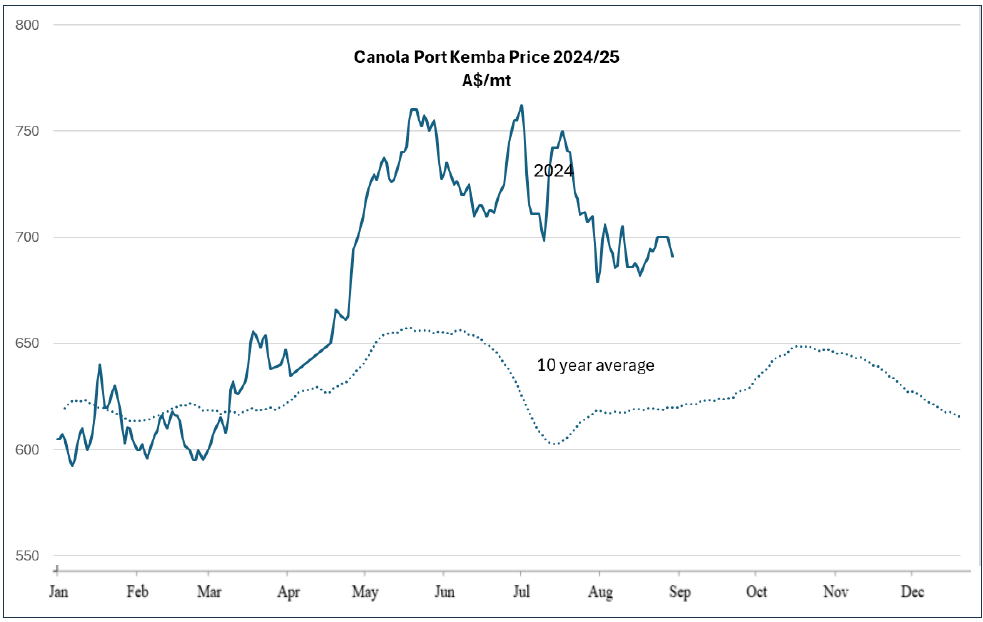

On a relative scale, the canola market continues to be more attractive than the wheat market. It is off the peaks made in July, but is still historically strong. At the start of September, Port Kembla canola bids were around $700/mt which is a Decile 8 level on the 10-year spectrum and Decile 6 on a 5-year range. Current exporter demand is strong for the coming harvest, with traders saying they have export sales booked.

The big news recently has been China’s announcement that they are launching an investigation into allegations of dumping of Canadian canola into their market. This is seen as retaliation for Canada’s move to place large tariffs on Chinese electric vehicles, plus Chinese steel and aluminium recently. China was Canada’s largest canola export customer last year, accounting for 72% of exports. The initial reaction was for Canadian canola markets to fall sharply. In the following days, markets have recovered, but a lot of uncertainty still remains for canola. Canada may have time to ramp up exports to China before any ban or trade barrier comes into place. This would be welcomed by Canadian growers as canola harvest just gets underway. China may turn to Australia for canola, but then where will the Canadians look to sell theirs to? It may be just a shuffling of the deck chairs so to speak. Europe should remain a key market for Australian canola, as they prefer non-GM, but price is the ultimate dictator if Canadian canola is cheap enough. Europe would just need to manage the GM meal produced from crushing, which it cannot use itself.

Canola basis has weakened a little on the China/Canada news. It is currently sitting at $77/mt under European rapeseed values, compared to the 10-year average of $66/mt under.

Upside potential

Import demand from Europe is expected to be strong this year, after a very disappointing harvest for their own rapeseed crop. This is a key market for Australian non-GM canola.

Even with a record US soybean crop expected to hit the market in the coming months, oilseed markets have been holding up well. Demand from China for US soybeans has been strong, with this underpinning soybean prices, which then rubs off onto other oilseed markets, including canola.

Canada is confident they can ride out any trade barriers placed on them by China. Their domestic canola crush capacity has been growing in volume over recent years, as more and more canola oil finds its way into the US biodiesel market. This has reduced their reliance on canola export markets, as they could divert any lost Chinese demand into other import destinations.

Canada’s canola harvest which has started, is now looking to be smaller that initial forecasts, with poorer yields so far than was expected. A dry, hot finish to the season took the edge off yields.

Downside potential

With the current price differential between wheat and canola, it is very likely that NSW growers will be much more willing sellers of canola than wheat at harvest, if the market picture looks the same. ABARES have forecast the NSW canola crop at 1.8mmt which is up 200kmt from their June forecast. Canola basis could come under pressure at harvest, if growers are sellers plus exporters and domestic crushers get the coverage they need soon.

Oilseed markets are closely correlated to crude oil markets as so much is consumed by the biofuels sector. If economies slow down and/or crude oil prices sink, oilseed markets will come under pressure as well. Given the current conflict in the middle east and China’s economic slowdown, this could be a factor affecting all oilseed markets, including canola.

The information contained in this article is given for the purpose of providing general information only.