Wool Market Update (December 2022)

The following graph shows the AWEX Eastern Market indicator (EMI) in cents per kilogram clean, from 2014 to date.

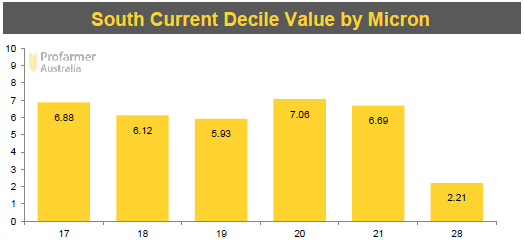

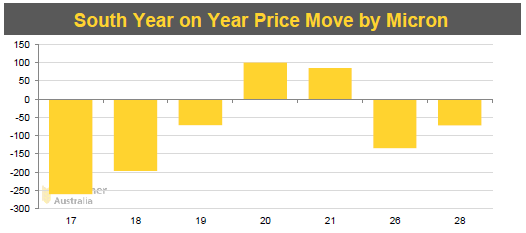

The wool market has declined relatively consistently since July. Finer micron wools are suffering the greatest falls, albeit from a very high base, as shown in the Profarmer graph below. Year on year 17-18 micron wool has decreased by approximately 16%. The falling market is predominantly due to continued weak demand out of China, resulting from reduced production capacity and domestic demand linked to their continuation of COVID-19 restrictions. Hopefully as China slowly reduces restrictions, economic activity increases leading to more demand. European buyers though have continued to purchase superfine wool and provide some support to the market. However, the reality is that China purchases approximately 80% of the Australian clip, with 40% of that consumed internally. Any change to Chinese supply and demand will lead to significant fluctuations in the domestic wool price.

The decline in prices can lead to significant pessimism about the value/future of wool and Merino production systems. It is worth noting in the chart below, that current prices are still approximately average for the previous 8 years. Provided the cost of production hasn’t increased dramatically, Merino production systems can still be very profitable and low risk.

With the EMI currently sitting at 1,224 c/kg clean, this should result in net average returns to clients with 19 micron Merino clips, of around $9.95/kg greasy assuming a yield of 65%. This would produce a return of $59.70/head net for sheep cutting 6.0 kg/head greasy.