Interest Rate Update (December 2022)

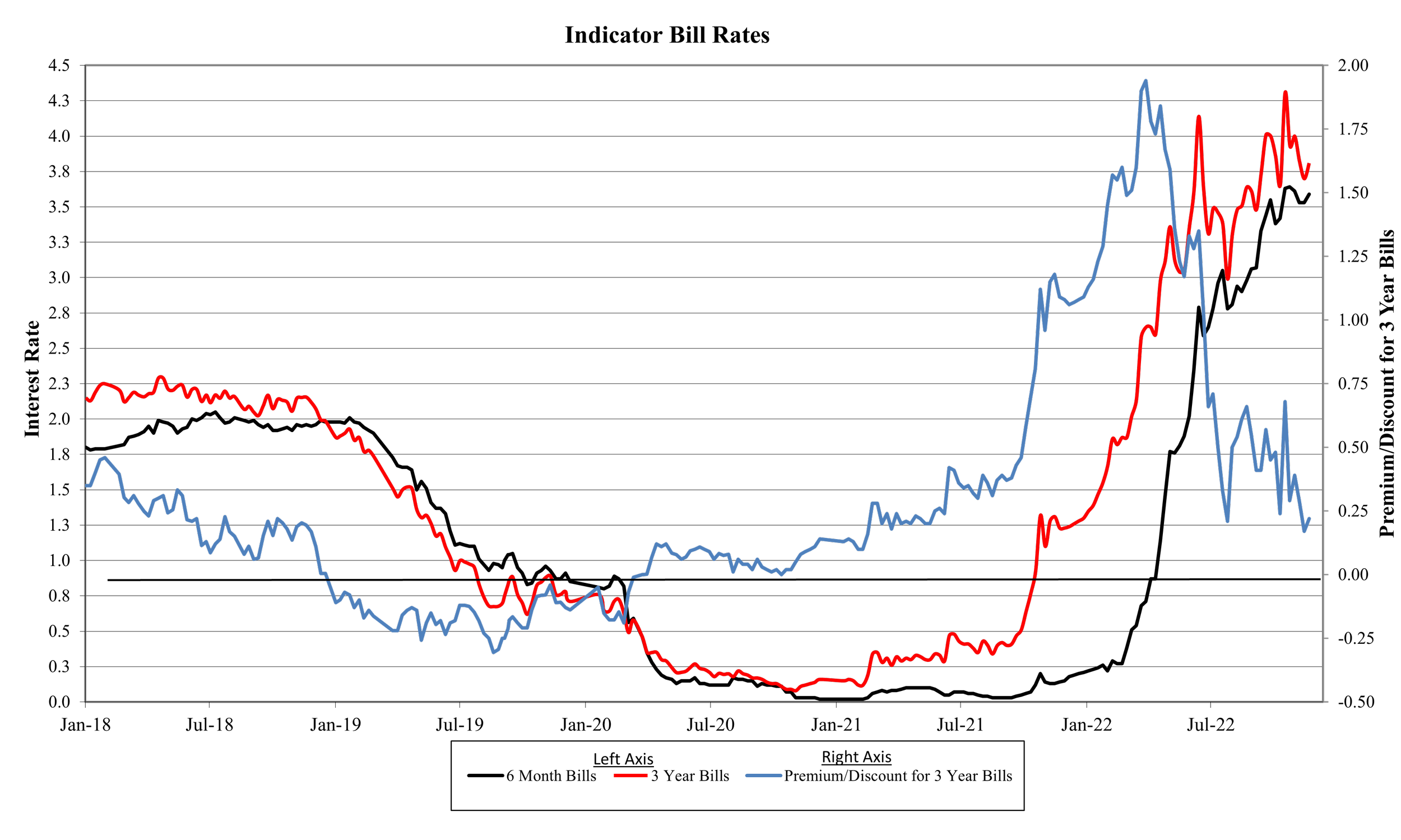

The following graph shows movements in both the 6 month and 3 year Bank Bill yield rates, for the period January 2018 to date, plus a representation of the premium or discount for the 3 year Bills over the 6 month Bills.

These rates are wholesale rates which are net of any margin charged by financial institutions. It is not uncommon for retail premiums for 3 year fixed rates, to be 0.30% pa or 30 basis points above the wholesale rate.

Currently the 6 month wholesale Bill rate is 3.59 % pa and the 3 year wholesale Bill rate is 3.81 % pa, a premium of 0.22% pa or 22 basis points for the longer term. The premium for the longer term has reduced dramatically since March 2022, when the premium for 3 year Bills over 6 month Bills peaked at 1.94%. This is an indication that the market may see only modest increases in interest rates heading into 2023, in comparison to the rapid rise seen in 2022.

Increased interest rates have been instigated by rapidly rising inflation rates both domestically and internationally. Recently, domestic inflation rates have fallen, due to reduced discretionary spending by consumers, plus a reduction in the COVID-19 induced logistical issues limiting production and transport of goods.