Interest Rate Update (November 2021)

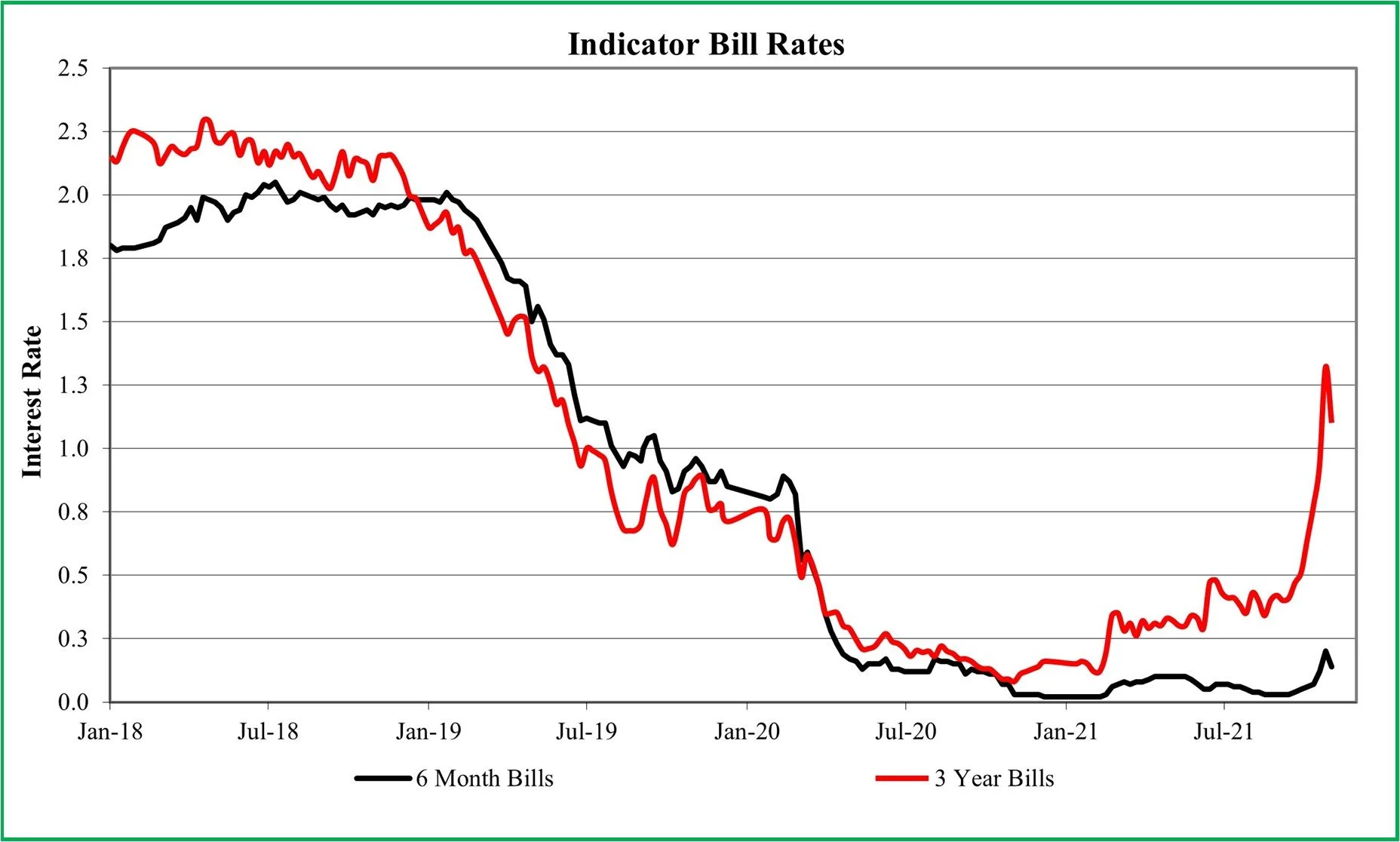

The following graph shows movements in both the 6 month and 3 year Bank Bill yield rates, for the period January 2018 to date.

These rates are wholesale rates which are net of any margin charged by financial institutions. It is not uncommon for retail premiums for 3 year fixed rates, to be 0.30% pa or 30 basis points above the wholesale premium.

Currently the 6 month wholesale Bill rate is 0.14% pa and the 3 year wholesale Bill rate is 1.1 % pa, a premium of 0.96% pa or 96 basis points for the longer term. This premium for the longer term is a reflection of renewed confidence in the economic recovery from COVID-19.

The incredibly rapid rise in the 3 year Bill rate is due to significantly higher inflation rates than expected, leading to the RBA indicating that rates may need to be increased prior to their previously stated prediction of 2024. The 96 basis point premium to fix rates is unattractive at present, however the fixed interest rates of individual banks can vary significantly, so it is important to investigate the different options available.