Grain Market Update - Wheat (November 2021)

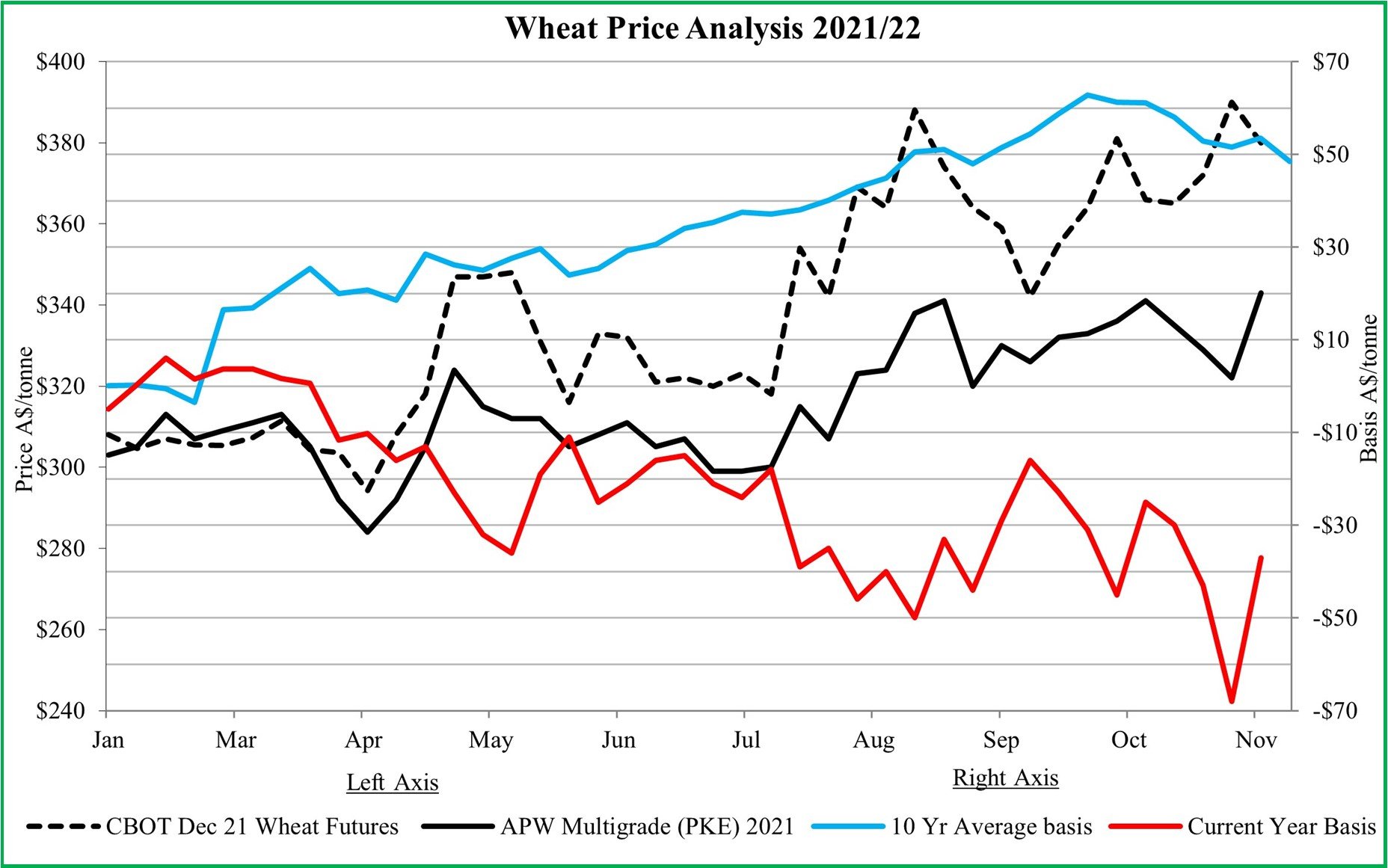

The following graph shows the movement in the Chicago (CBOT) December 2021 Wheat Futures price expressed in A$ and the 2021/22 APW Multigrade price delivered Port Kembla. Also included is the 10 year average CBOT December Futures basis for the APW Multigrade price at Port Kembla, plus the corresponding basis for the current year.

Currently the APW Multigrade price is $343/tonne delivered Port Kembla, while the CBOT December 2021 Wheat Futures price is trading at A$380/tonne equivalent, resulting in a basis of -A$37/tonne. This compares with the 10 year average basis of A$54/tonne for this time of the year.

As the graph below indicates, both international and domestic markets have been volatile, with factors independent of each other, causing these price variations which can been seen in the week to week changes in the current year basis. International futures prices are supported by reduced global supplies due to adverse weather conditions, coupled with slightly higher consumption leading to lower ending stocks.

International prices are significantly higher this year compared with this time last year, with CBOT futures trading around US770c/bu compared with around US600c/bu last year. This 28% increase in CBOT prices has been tempered slightly by an increase in the A$/US$ exchange rate from US 73c to US 74c over the year.

However the increase in local Australian prices has lagged that of international prices, resulting in a reducing basis ie more negative, due to local supply chain constraints which limit the amount of wheat which can be exported at these high international prices.

The current APW price at Port Kembla is a Decile 8 price, calculated on prices from 2009 to date. The decile price this time 12 months ago was approximately 5.

Assuming freight to port of $38/tonne, the present Multigrade price represents $305/tonne local depot, which should be well in excess of clients’ Break Even Price at expected above average yields.