Interest Rate Update (April 2019)

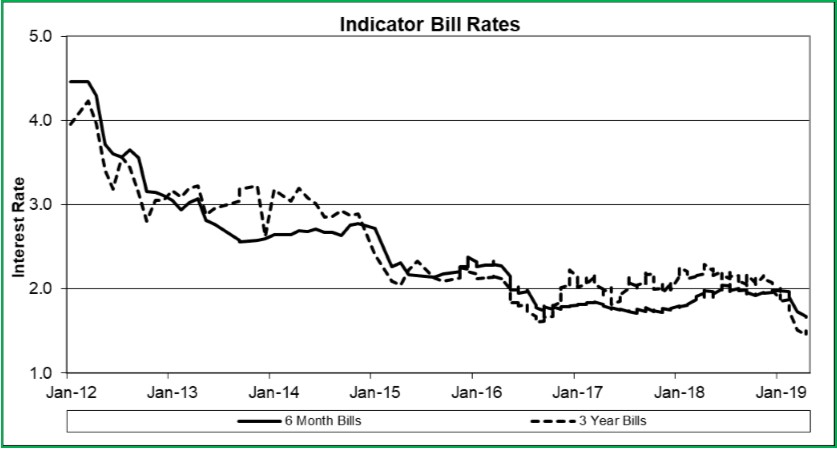

The following graph shows movements in both the 6 month and 3 year Bank Bill yield rates, for the period January 2012 to date.

These rates are wholesale rates which are net of any margin charged by financial institutions. It is not uncommon for retail premiums for 3 year fixed rates, to be 0.30% pa or 30 basis points above the wholesale premium.

Currently the 6 month wholesale Bill rate is 1.66% pa and the 3 year wholesale Bill rate is 1.50% pa, a discount of 0.16% pa or 16 basis points for the longer term. This discount for the forward rate suggests that rates are more likely to fall than rise in the medium term, although they may well remain stable at current levels. This inverse yield curve in the wholesale market, may represent an opportunity for clients with large core debts, to execute some interest rate hedging strategies.